At least 72% of students say personal finance stresses them out,1 and COVID-19 could put an added financial burden on many young people, from disrupted financial aid to layoffs to a challenging post-graduation job market. Now more than ever, students need education and resources to help them understand how to make it through these difficult financial times.

That’s why DoSomething.org, the largest organization for young people and social change, and HSBC, one of the world’s largest banking and financial organizations, have partnered to launch “Would You Rather?”, an engaging and impactful financial literacy campaign in time for Financial Literacy Month, designed to educate young people on making and saving money. The campaign is fully digital, so young people can learn to budget and save while safely social distancing.

Through “Would You Rather?”, tens of thousands of young people will answer 5 amusing financial questions such as: To save money, would you rather… a) Share a cellphone with your grandma? or b) Share a closet with your ex? After each question, they’ll receive a personal finance tip and, ultimately a comprehensive digital personal finance guide they can use and share with friends to take control of their financial lives. Students around the country will also be able to use the campaign’s resources to facilitate in-person financial literacy workshops at their schools and communities. The finance guide and the workshops were created in partnership with HSBC expertise from the bank’s “Your Money Counts” program and their partners at Greenpath Financial Wellness.

“Considering the student debt crisis, the cost of education, and the cost of just life in general, it’s no surprise that money is a huge point of stress for students,” says Carrie Bloxson, Chief Marketing Officer of DoSomething.org. “That’s why we’re so proud and excited to team up with HSBC for “Would You Rather?”. Sure, the questions are amusing, but the impact is real — through the campaign, thousands of young people will educate their friends on financial literacy and empower them to take control of their financial lives.”

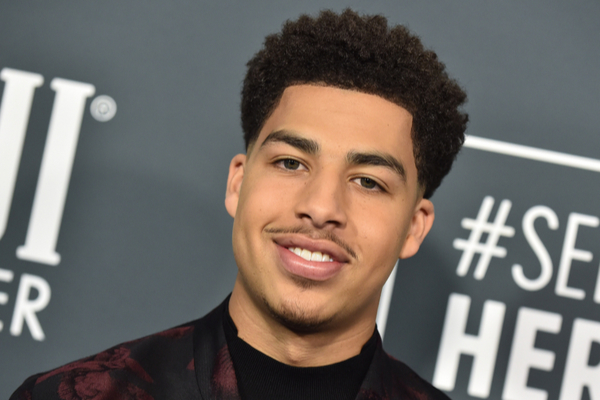

In the campaign’s PSA launch video, the magnetic and hilarious Marcus Scribner – best known for his role on Black-ish – hosts (and competes in!) a “Would You Rather?” style game show of questions and answers designed to engage and educate young people on the topic of financial literacy, and encourage them to sign up for the campaign.

“For lots of people my age, dealing with money can feel intimidating, overwhelming, and honestly just stressful. That’s why I’m so pumped about “Would You Rather?”, because young people can learn really important stuff about making and saving money just by taking the kind of quiz they would take online anyway,” says Scribner, 20.

Influencers who are passionate about financial literacy for young people are also lending their platforms and voice to support this campaign, including self-proclaimed “financial hype woman” Berna Anat, who paid off $50,000 in debt in 2017 and now creates helpful and informative financial content for Gen-Z and Millennials, Katherine Berry, whose popular YouTube channel is dedicated to life and work advice for young people, and Gen Z entrepreneur and creative strategist Jade Darmawangsa, whose podcast, “The Raisn Brand”, helps other entrepreneurs use social media to grow their business.

—

Photo Credit: DFree / Shutterstock.com